In the realm of taxation, the Goods and Services Tax (GST) stands as a pivotal reform, presenting both advantages and disadvantages of gst that reverberate through the economic fabric. As a transformative system designed to simplify indirect taxes, GST has shaped business landscapes and consumer experiences. In this exploration of the advantages and disadvantages of GST, we unravel the intricacies surrounding this tax overhaul. From its touted benefits to the challenges it poses, our journey delves into the multifaceted impact of GST on businesses, consumers, and the broader economic canvas.

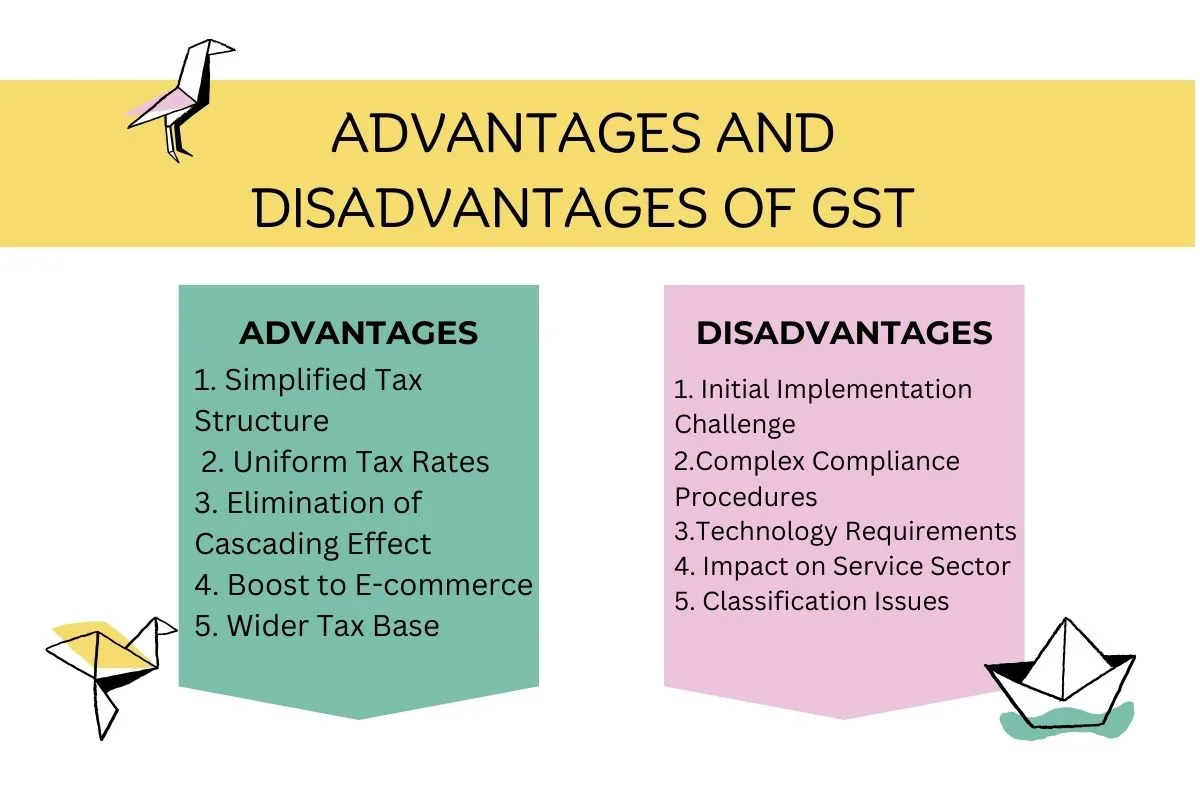

Advantages and Disadvantages of GST

| Advantages of GST | Disadvantages of GST |

|---|---|

| 1. Simplified Tax Structure | 1. Initial Implementation Challenges |

| 2. Uniform Tax Rates | 2. Complex Compliance Procedures |

| 3. Elimination of Cascading Effect | 3. Technology Requirements |

| 4. Boost to E-commerce | 4. Impact on Service Sector |

| 5. Wider Tax Base | 5. Classification Issues |

| 6. Reduction in Tax Evasion | 6. Burden on Small Businesses |

| 7. Improved Logistics and Supply Chain Efficiency | 7. Initial Inflationary Pressures |

| 8. Encouragement to Formal Economy | 8. Multiple Slabs |

| 9. Facilitation of Foreign Trade | 9. State-level Variances |

Advantages of GST (Goods and Services Tax)

1. Simplified Tax Structure:

GST has replaced a myriad of indirect taxes like VAT, service tax, and excise duty, simplifying the overall tax structure. Businesses now deal with a unified tax system instead of navigating through multiple tax categories.

2. Uniform Tax Rates:

GST promotes uniformity in tax rates across states, creating a more standardized taxation system. This consistency reduces complexities for businesses operating in multiple states.

3. Elimination of Cascading Effect:

The input tax credit mechanism of GST eliminates the cascading effect of taxes. Businesses can claim credits for taxes paid on inputs, ensuring that taxes are only levied on the value addition at each stage of production.

4. Boost to E-commerce:

GST has simplified tax compliance for e-commerce businesses, fostering a conducive environment for growth. It has streamlined tax processes and facilitated smoother interstate transactions.

5. Wider Tax Base:

GST has expanded the tax base by bringing previously untaxed sectors into the formal economy. This broadening of the tax base has increased government revenue.

6. Reduction in Tax Evasion:

The digitized nature of GST promotes transparency and traceability in transactions, making it more challenging for businesses to evade taxes. This has resulted in improved compliance and revenue collection.

7. Improved Logistics and Supply Chain Efficiency:

GST has led to the removal of interstate check posts, reducing delays in the movement of goods. This streamlined logistics has positively impacted supply chain efficiency.

8. Encouragement to Formal Economy:

The shift to GST encourages businesses to operate within the formal economy to avail themselves of input tax credits. This move towards formality contributes to the overall economic structure.

9. Facilitation of Foreign Trade:

GST has simplified export and import procedures, making it easier for businesses engaged in foreign trade. The integrated tax system has reduced paperwork and compliance hurdles.

10. Harmonization of Tax Laws:

GST harmonizes tax laws across states, promoting consistency in interpretation and application. This reduces confusion for businesses operating in multiple regions.

11. Consumer Benefits:

The rationalization of tax rates under GST often leads to reduced product costs, benefiting consumers. This can contribute to increased purchasing power.

Disadvantages of GST

1. Initial Implementation Challenges:

The initial rollout of GST faced challenges such as system unavailability, confusion about filing processes, and adaptation issues, causing disruptions for businesses.

2. Complex Compliance Procedures:

While GST aims to simplify taxation, the compliance procedures can be intricate, especially for small businesses. The multiple return filings and technological requirements can pose challenges.

3. Technology Requirements:

Small businesses may struggle with the digital requirements of GST, as they may lack the necessary technological infrastructure. This could potentially lead to compliance difficulties.

4. Impact on Service Sector:

Some services experienced an increase in tax rates under GST, affecting their cost structure. This has led to debates on the fairness of tax rates across different sectors.

5. Classification Issues:

The classification of goods and services under specific tax slabs has led to debates and disputes. Ambiguities in classification can create uncertainties for businesses.

6. Burden on Small Businesses:

The compliance burden of GST may be relatively higher for small businesses. The resource constraints in handling complex compliance procedures can impact their operational efficiency.

7. Initial Inflationary Pressures:

The transition to GST initially caused inflationary pressures as businesses adjusted to the new tax structure. Changes in pricing and product rates contributed to this

temporary inflationary effect.

8. Multiple Slabs:

The presence of multiple tax slabs has been criticized for complicating the tax structure. Some argue for a simpler, single-rate structure to enhance ease of understanding and compliance.

9. State-level Variances:

GST has uniform tax rates across states, but differences in state policies, interpretation, and implementation can still lead to variances, creating challenges for businesses operating nationally.

10. Increased Compliance Costs:

Businesses may face additional costs in adapting their systems to comply with GST requirements, particularly if they operate in multiple states.

11. Impact on Small Traders:

Small traders may find it challenging to adapt to the digital requirements and may face difficulties in complying with GST, affecting their competitiveness.

Conclusion

In conclusion, while GST has brought about transformative changes, addressing challenges related to compliance, technology, and sector-specific impacts is vital for ensuring its continued effectiveness. Ongoing refinements and adaptations are necessary to maximize the benefits of this significant tax reform.